Posted:

Saturday, July 1, 2023

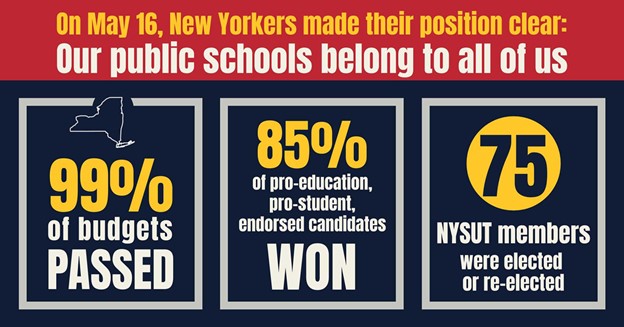

Last month, unions across the state of New York racked up huge victories in budget votes and school board elections. Here on Long Island, locals showed up in large numbers to win contested Board of Education elections, and in what may be a trend of things to come, advocated for the piercing of the 2% property tax cap to allow their districts to protect valuable school programs and provide needed services to the children in their communities.

The numbers in the graphic above offer evidence of what can happen when people within a union work together for the mutual benefit of all stakeholders in a school district. In a powerful show of force, the Brentwood Teachers Association succeeded in their two year-long campaign to flip two seats on the Brentwood Board of Education. According to Brentwood Teacher’s Association President, Kevin Coyne, volunteers from the Brentwood Teacher’s Association volunteers made nearly 4,500 phone calls and knocked on nearly 2,000 doors to elect retired Brentwood teacher, Eileen Harman and Brentwood School District graduate, Brandon Garcia, to the Brentwood Board of Education.

Perhaps even more impressive than the efforts of the Brentwood Teachers Association were the efforts by two locals on Long Island – Babylon and Montauk - to convince their communities to pierce the 2% property tax law.

The New York State property tax cap law has been in effect since 2011. It states, in essence, that local school districts cannot raise annual property taxes by more than 2% each year. If a school district should choose to exceed the property tax cap, the vote to approve in the district must be by a 60% or more supermajority.

One problem for districts trying to pass budgets that stay within the property tax cap is that a 2% increase in taxes often does not keep up with the rate of inflation. The Bureau of Labor Statistics Consumer Price Index shows that since the tax cap was enacted in 2011, the U.S. dollar has had an annual inflation rate of 2.52% each year. Because the tax cap law does not allow districts to assess their communities at a rate equal to the rate of inflation, districts often find themselves unable to maintain programs. This is led over the last 12 years to debilitating cuts in course offerings, student and community services and extra-curricular programs. It has also resulted in districts being unable to offer salaries that keep up with the general cost of living increases in the communities where teachers work.

This issue where capping property taxes has resulted in cuts to programs and an inability to fully compensate teachers is certainly not exclusive to New York State. A recent review by the National Education Association showed that teachers across America are making $3,644 less, on average, than they did 10 years ago when those salaries are adjusted for inflation.

In the Babylon Union Free School District, devastating cuts to curricular programs, sports, and arts and music programs were planned if the district decided to propose a budget under the 2% tax cap. The Babylon Teachers Association (BTA), led by President, Robert Richardelli, knew it was time to act. Due to the BTA’s advocacy, the district was encouraged to put forth a 4.84 percent budget increase that would avoid the worst of the proposed cuts. Being one of the only districts on Long Island to exceed the 2% cap required a huge grassroots effort from the BTA and other school community advocates in the Babylon PTA and elsewhere. The school budget passed by 61.9% of the vote.

Without question, passing necessary budget increases that exceed the 2% property tax cap and installing members of Boards of Education that support public education are not easy tasks. But, as was shown this year across New York State, especially here on Long Island, positive changes can take place with the advocacy of a strong union movement taking the lead.

Found in:

2017 NYSUT Communications Award - Best Website

2017 NYSUT Communications Award - Best Website